Oversight bill seeks to address 'serious and ongoing problem' with oil tax transparency

The Dunleavy administration's secrecy has created a troubling blind spot where legislators cannot say for sure that Alaska is getting what it rightfully should.

It's Tuesday, Alaska! Day 106 of the legislative session.

In this edition: As the session enters its final two weeks, the Senate unanimously approved legislation on Monday to strengthen the power of the legislative auditor due to an ongoing problem surrounding the state's oil and gas tax regime under Gov. Mike Dunleavy. Is the state getting everything it's owed from the oil industry? Legislators are no longer willing to take the governor's word for it. Also, a wayyyyy too early power ranking of Alaska's gubernatorial race.

Current mood: 😵💫

Oversight bill seeks to address 'serious and ongoing problem' with oil tax transparency

In the decade-plus I've covered the Alaska Legislature, I've spent a lot more time thinking about how the state spends oil taxes than how it collects them. And that's not just because spending money is more exciting, but because Alaska's oil and gas tax regime is also about as complicated and drawn-out as you could make it. Tax assessments – revisions to past tax bills based on audits of completed financial books – are a regular part of life, as is the lengthy appeals process that can also take several years before the state knows for sure what it generated.

That alone can make tracking oil taxes tricky, but when combined with a Dunleavy administration that is both friendly to the oil and gas industry and particularly antagonistic with the Legislature, it has created a troubling blind spot where legislators cannot say for sure that Alaska is getting what it rightfully should.

This week, the Alaska Senate voted unanimously to start getting to the bottom of that by passing Senate Bill 183. The measure would strengthen the Legislature's oversight powers by requiring the administration to comply with legislative audits.

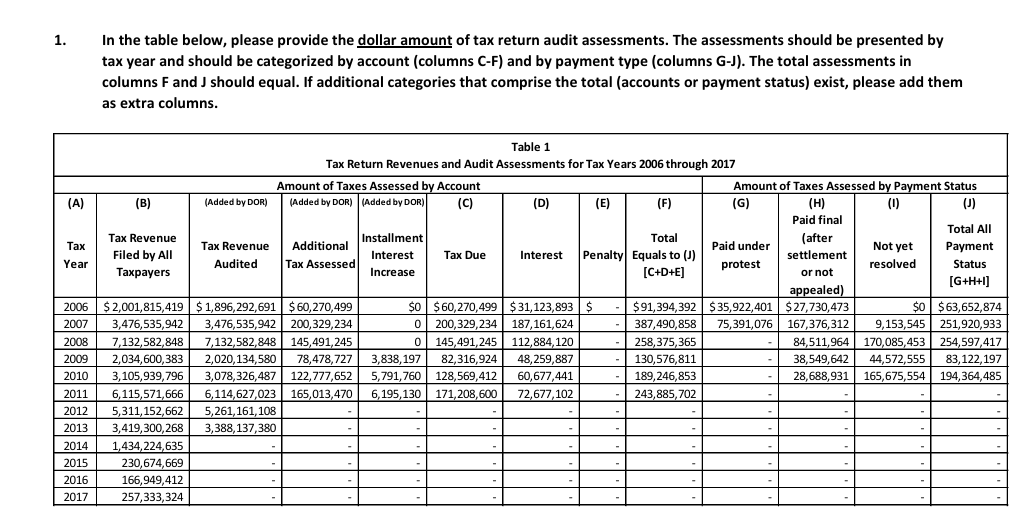

At the heart of the issue is the Department of Reveune's decision to cut off the flow of information on tax assessments to the Alaska Legislature in 2019, refusing to provide an annual report on the topline numbers of taxes, interest and penalties incurred by oil and gas companies (individual companies' tax information is confidential). The last such report was released by the Alaska Tax Division in 2018, detailing somewhere in the ballpark of about $1.3 billion in taxes and penalties due from tax years 2006 through 2011. Producers had paid about $450 million and settled another $200 million, leaving $645 million unresolved at the time.

Just what has happened since then, not only to the $645 million ($900 million, if we're including numbers from 2012 that have been reported elsewhere) but also in the subsequent tax years, is unknown. After halting the report under the claim of confidentiality, the Department of Revenue has since refused to work with the Legislature's auditor – a position outlined in the Alaska Constitution – to update the report, leaving legislators – and the public – in the dark.

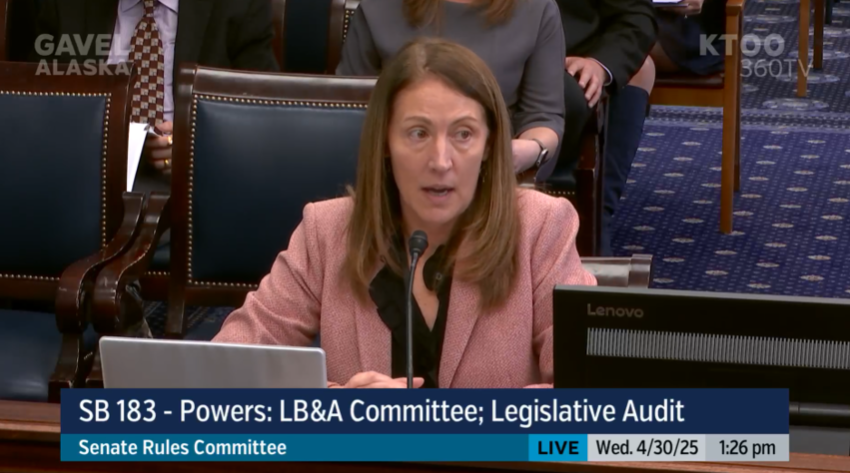

At a hearing last week, Legislative Auditor Kris Curtis detailed her struggles with getting information from the Department of Revenue and how it's left her with an incomplete picture of one of the state's biggest sources of revenue. She said that without the additional powers in Senate Bill 183, she cannot do her job, and the Legislature won't be able to exert its oversight powers.

"Reluctance on behalf of the Department of Revenue to provide information from the audit perspective raises a lot of red flags," she said. "I have concerns from an audit perspective of why, and I would like to help determine that. Not just for you, but for the public."

There have been attempts to ballpark the settlement amounts by keeping a tab on the Constitutional Budget Reserve, the account where tax settlements are deposited, but that has also proven frustrating. One of those keeping an eye on the deposits is Senate Finance Committee co-chair Sen. Bert Stedman, R-Sitka, who noted at last week's hearing that the deposits have fallen below what's expected. But whether that's a result of the administration cutting sweetheart settlement deals, a function of low-oil price years coming onto the books, or a little bit of both is unknown to legislators, and the state hasn't been forthcoming.

"We're dealing with hundreds of millions into the billions of dollars, this is not decimal dust," said Sen. Bert Stedman, R-Sikta, at a Senate Rules Committee hearing on the bill last week. "(Settlement payments) appear to have precipitously dropped the last couple of years for whatever reason. That alone would warrant a review because it sticks out. Could very well be a function of price and expenditures and how internal business is doing or not. Without a review, it's an open question, but it definitely sticks out."

After years of struggling and failing to get those answers, legislators are now turning to a change in the law in the form of Senate Bill 183 to compel the executive branch to comply with the Legislature's oversight powers, which backers are quick to point out are outlined in the Alaska Constitution.

The legislature shall appoint an auditor to serve at its pleasure. He shall be a certified public accountant. The auditor shall conduct post-audits as prescribed by law and shall report to the legislature and to the governor.

Article IX, Sec. 14

Sen. Elvi Gray-Jackson, D-Anchorage, is the chair of the Legislative Budget and Audit Committee and said during the floor debate on Monday that many efforts to get detailed information on the oil and tax system have been denied by the state. She said that sets a dangerous precedent.

"If executive branch agencies can pick and choose what information to provide or in what format, then they can intentionally or not obstruct the Legislature's ability to perform independent oversight on behalf of the public, effectively hiding billions of dollars from public view," she said. "Frankly, this is action we should have taken some time ago."

Sen. Bill Wielechowski, an Anchorage Democrat and longtime critic of the oil industry, called it a "serious and ongoing problem" that could have a significant impact on the state's financial health.

"Why does this matter?" he said. "Because the stakes are high. The 2018 data provided by the department covered six years of assessments and showed more than $1.3 billion in additional tax and interest. That's not theoretical. That's real money resulting from real audits directly affecting the state's bottom line."

Even conservative Republicans who are typically closely aligned with Gov. Mike Dunleavy supported the measure. They said their main concern, that the legislative auditor might "go rogue," was addressed and that the Legislature's constitutional right to audit and review the state was being properly exerted.

The bill passed 19-0 and is already scheduled for a hearing in the House Rules Committee on Thursday morning.

Stay tuned.

Follow the thread: The Senate Rules Committee hearing on SB 183

And now, a way-too-early power ranking of Alaska's 2026 governor's race candidates

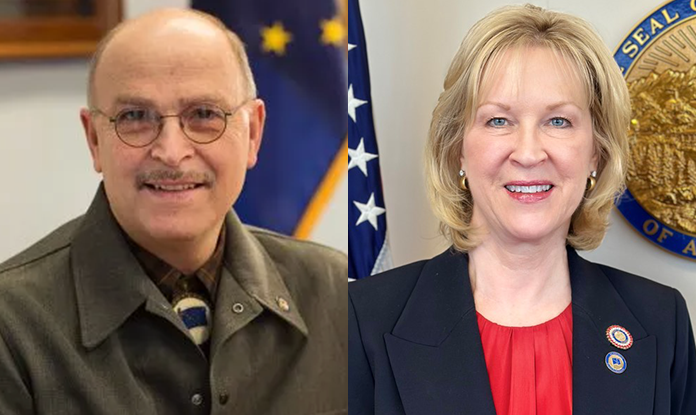

With Gov. Mike Dunleavy reaching the term limit, the 2026 race for governor is wide open. Republicans Click Bishop, a former Fairbanks senator, and Nancy Dahlstrom, the current lieutenant governor and failed-to-launch candidate for U.S. House, kicked things off by announcing their candidacy on Monday.

Of course, the race is far off and much will change between now and when voters go to the polls, but let's take a moment to power rank our two candidates.

- Click Bishop

- Pro: An affable pro-labor moderate who could and wants to bridge the political schisms in Alaska to build a better future for all

- Con: How many people really know state legislators?

- Nancy Dahlstrom

- Pro: A conservative who ostensibly has statewide recognition after running for lieutenant governor and making a Trump-endorsed run for U.S. House

- Con: Was forced out of the U.S. House race by the Republican party machine after a disappointingly bad primary performance

Stay tuned!

The Alaska Memo Newsletter

Join the newsletter to receive the latest updates in your inbox.